Note on Global Depository Receipts

Global Depository Receipts (GDR) are now a widely popular instrument for Indian companies looking to raise funds from international investors. It helps the Indian company to raise patient capital from high quality like-minded investors without fixed repayment commitments. GDR derive their value from the equity shares in the Indian company and the return on investment for GDR holders too can be achieved through value unlocking or value creation in the Indian company.

For raising funds for litigation funding or assignment of share in arbitral awards which is still a non-existent market in India and the investors by default will be foreign entities, GDR a is highly attractive option that Indian companies may explore for funds raise.

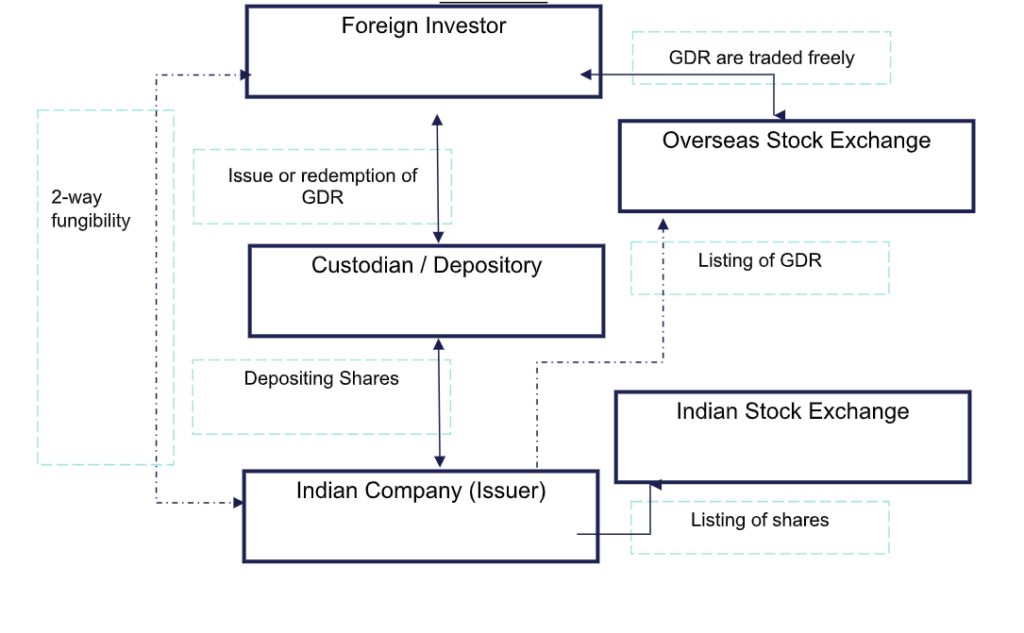

GDR are a negotiable security issued outside India by a depository bank, on behalf of the Indian company, which reflects the local rupee denominated equity shares of the company held as deposit by a custodian bank (‘CB’) in India. Each GDR a pre-decided number of shares of the Indian company. GDR can be converted into shares of the company if the GDR holder chooses to and the GDR holder can again get the shares converted into a GDR (2-way fungibility). (Flowchart enclosed as Annexure I).

Listing of GDR

GDR can be issued by way of public offering or private placement or in any other manner prevalent abroad and may be listed or traded in an overseas listing or trading platform. Issuer Indian Company has to comply with the rules of the exchange the GDR are listed on.

GDR can be listed on the London, Luxembourg or Singapore Exchange. Luxembourg may be the preferred exchange due to low compliance requirements. Recently, the Government of India has also allowed GDRs to be listed on the stock change in International Financial Services Centre (IFSC) in India.

Enhanced Credibility and Re-rating of Stock Price in India

Raising funds via GDR creates visibility and interest in the international investor community for the Company providing a USD denominate listed instrument requiring no compliances in India and thereby it helps the Indian Company to widen and diversify its pool of investors and improves its reputation and credibility in its shareholder community. This may most likely lead to re-rating of the company’s stock in India which may result in appreciation of underlying share price benefitting both existing investors (shareholders in India) and new investors (GDR holders).

No Cap on Issue Size

There is no maximum limit on the amount of funds that can be raised by an Indian company via GDR Issue.

No Requirement of Regulatory Clearance

GDR being a way of directly subscribing to capital of Indian Companies by non-residents, is termed under Foreign Direct Investment (‘FDI’). If a company is allowed to raise FDI under the automatic route (example companies in the manufacturing sector), it does not need any regulatory clearance for issuing GDR.

No Restrictions on End Use

There is no bar on end use of the proceeds of GDR by the Indian Company except for investment in real estate or stock markets.

Currency Fluctuation Risk is borne by the GDR Holder

GDRs derive their value from the underlying shares of the Indian Company which are valued in Indian Rupees in India. Even dividend is paid by the Indian company in Indian Rupees.

No Tax in India if GDR is Sold by One Non-resident to Another Non-resident

A non-resident can freely transfer GDRs to another non-resident via sale or gift. Due to specific exemption given under section 47 of the Income Tax Act the same is not treated as transfer and not liable to capital gain tax in India. In other cases, profit on sale of GDR is taxed at a concessional rate in India (10% for long term capital gains).

Allowing Buy-back Agreements Outside Indian Regulatory Requirements

Through buyback agreements in overseas jurisdiction, the beneficial ownership etc. can be structured.

Annexure 1