IPO Alert – Indigo Paints Ltd

Indigo Paints Limited is the 2nd IPO to open for subscription this week. The first IPO [ IRFC IPO closes on 20th Jan, 2021 – link to our IRFC IPO note in the first comment] was a PSU with a low-risk, stable returns business model.

Indigo Paints is the complete opposite. It’s the classic example of a “Growth” stock. It is richly valued and yet the stock market players are excited about it. If the growth story plays out Indigo Paints might be give handsome returns but if the growth falters, markets will punish the stock price cruelly.

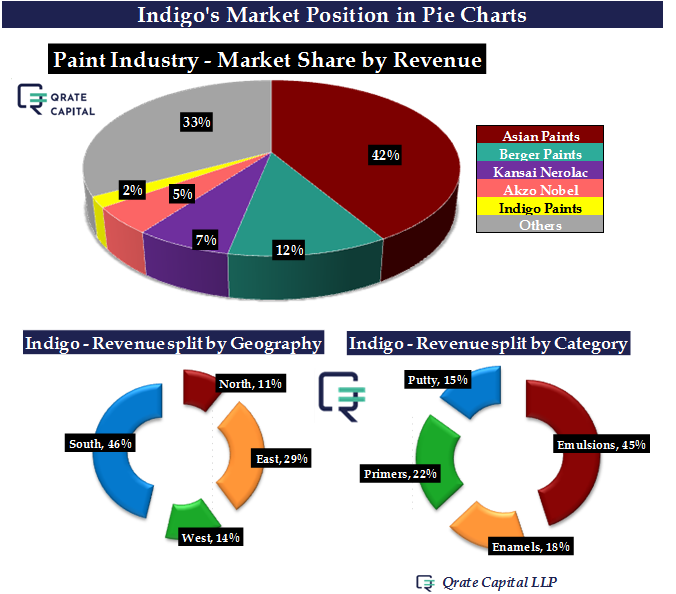

Where does Indigo Paints stand today?

Is the IPO worth the risk? Should you subscribe? May be our note will help you make an informed decision.

Indigo Paints IPO – Analysis Note

#IPO #IndigoPaints #investing #financialplanning

Please note this is not a tip/recommendation. Please consult an advisor.