IPO Alert – Indian Railway Finance Corporation (IRFC IPO)

As you guys might have heard, Indian Railway Finance Corporation [IRFC] IPO is all set to become the first IPO of 2021. While I was analysing the company, I came across a very interesting table. The table had the details of every rupee invested by the Government of India in IRFC.

The GoI has infused equity in IRFC on ~20 different instances – first instance was in 1986 while the latest was in March 2020. I was curious to know how much returns has the GoI made on its investment.

So, I plotted the table in an excel sheet and did a few calculations:

Total amount invested = Rs 11,880 cr

Market Value of GoI’s stake post the IPO = Rs 29,362 cr

Well, that’s an IRR of 11.7% !

Not bad at all considering that other PSUs have been destroying public wealth year after year. It was heartening to find out that IRFC is an exception to this rule. Now, the question is whether IRFC can create wealth for you?

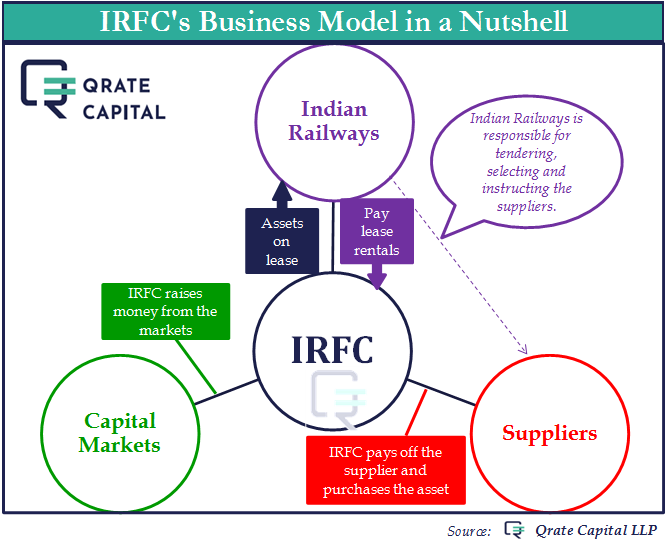

We have captured the business model in a concise flow chart.

But there are many more nuances that you need to know before you make a decision – financials, valuations, risks and opportunities.

Click on the link to access our Analysis of the IRFC IPO.

IRFC IPO – Analysis Note

#IRFC #IPO #Investment #FirstIPOof2021

Please note this is not a tip/recommendation. Please consult an advisor.